The interest rate is commonly expressed as a percentage of the principal amount (outstanding loan or value of deposit). Usually, it is presented on an annual basis, which is known as the annual percentage yield (APY) or effective annual rate (EAR). Start by entering your initial deposit or investment, or your current balance if you already have a deposit. Then enter how long you want to keep the deposit or investment, usually in years, but we also support other time periods. I hope you found this article helpful and that it has shown you how powerful compounding can be—and why Warren Buffett swears by it. Compound interest is interest that is calculated on the principal value and accumulated interest of an investment or loan.

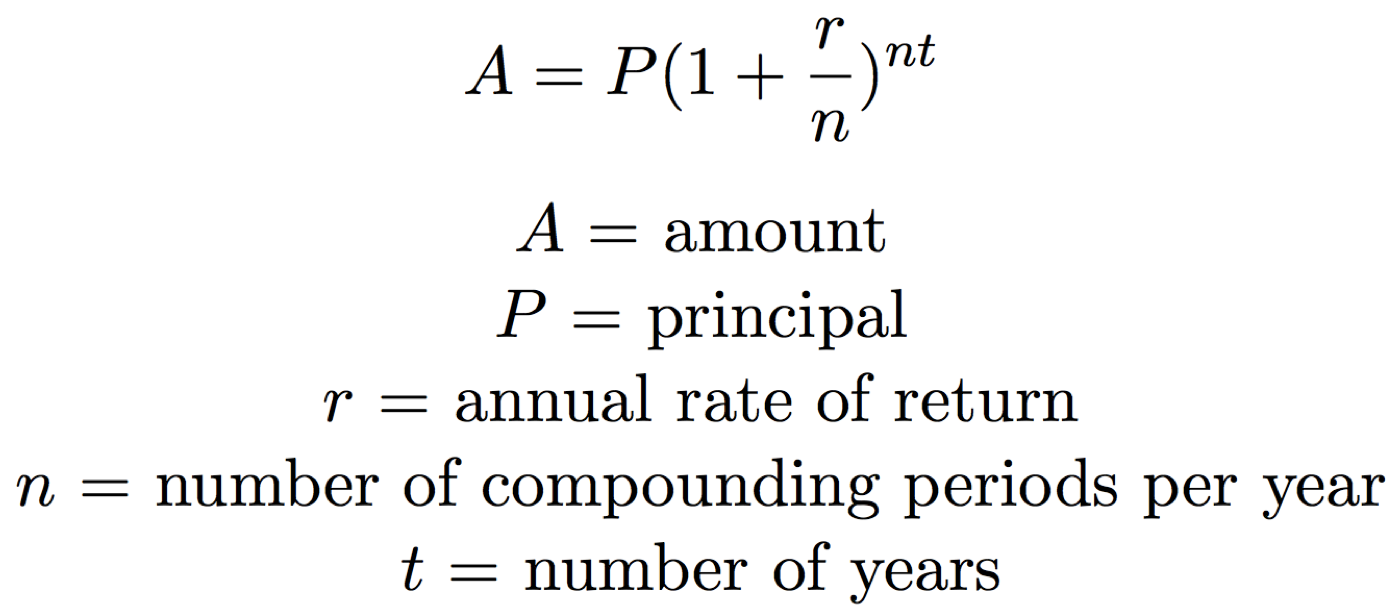

What is the compound interest formula?

You can also use this calculator to solve for compounded rate of return, time period and principal. There will be no contributions (monthly or yearly deposits) to keep the calculation simpler. If an amount of $10,000 is deposited into a savings account what is the margin of safety formula at an annual interest rate of 3%, compounded monthly, the value of the investment after 10 years can be calculated as follows… Interest can be compounded on any given frequency schedule, from continuous to daily, monthly, quarterly to annually.

How is compound interest calculated?

To understand how it does it, let’s take a look at the following example. Ancient texts provide evidence that two of the earliest civilizations in human history, the Babylonians and Sumerians, first used compound interest about 4400 years ago. However, their application of compound interest differed significantly from the methods used widely today. In their application, 20% of the principal amount was accumulated until the interest equaled the principal, and they would then add it to the principal. Three simple strategies to consider when doing your long-term financial planning. As always, we recommend speaking to a qualified financial advisor for advice.

Tax Rate

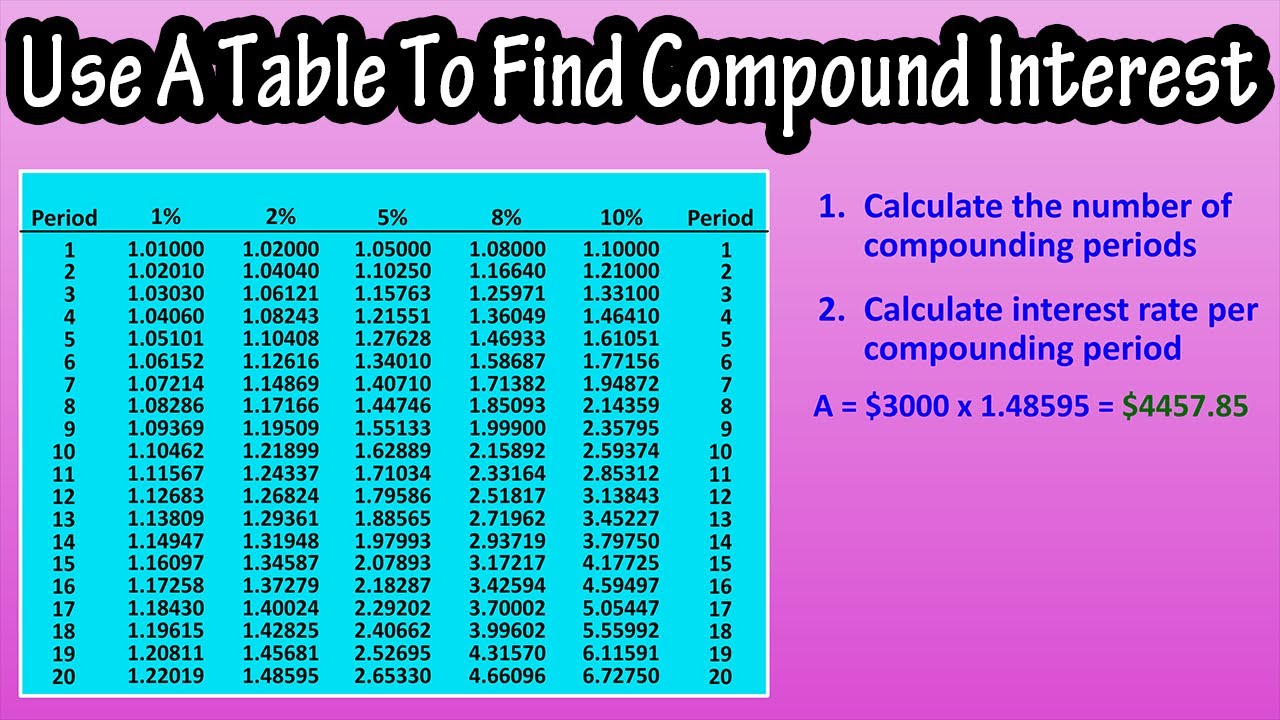

The frequency that interest is compounded can have a large effect on the growth over time. More regular compounding will result in faster growth since the growth is more exponential. This compound interest calculator gives the option for continuous, daily, monthly, quarterly, semiannually, and annually compounded interest, which are the most common and practical time intervals. Compound interest is the formal name for the snowball effect in finance, where an initial amount grows upon itself and gains more and more momentum over time. It is a powerful tool that can work in your favor when saving, or prolong repayment for debts. Compound interest is often referred to as “interest on interest” because interest accrued is reinvested or compounded along with your principal balance.

This is because rate at which compound interest grows depends on the compounding frequency, such that the higher the compounding frequency, the greater the compound interest. Compound interest occurs when interest is added to the original deposit – or principal – which results in interest earning interest. Financial institutions often offer compound interest on deposits, compounding on a regular basis – usually monthly or annually.

If you’d prefer not to do the math manually, you can use the compound interest calculator at the top of our page. Simplyenter your principal amount, interest rate, compounding frequency and the time period. You can also include regular deposits or withdrawals to see how they impact the future value. Compound interest is when interest you earn on a savings account or investment is rolled back into your balance to earn additional interest. The compound interest calculation accounts for interest you earn over time and adds it back into the amount being invested or saved.

Both the Fed rate and LIBOR are short-term inter-bank interest rates, but the Fed rate is the main tool that the Federal Reserve uses to influence the supply of money in the U.S. economy. LIBOR is a commercial rate calculated from prevailing interest rates between highly credit-worthy institutions. This formula can help you work out the yearly interest rate you’re getting on your savings, investment or loan. Note that youshould multiply your result by 100 to get a percentage figure (%).

Interest can technically be compounded at any time interval you would like, but the time intervals above are most common.

- When it comes to retirement planning, there are only 4 paths you can choose.

- This example shows the interest accrued on a $10,000 investment that compounds annually at 7% for four different compounding periods over 10 years.

- Simply divide the number 72 by the annual rate of return and the result of this is how many years it’ll take.

- You can use compound interest to save money faster, but if you have compound interest on your debts, you’ll lose money more quickly, too.

- As a result, a fixed amount of money will relatively afford less in the future.

So while you are earning interest on your original principal you are also earning interest on accumulated interest. The compounding period is the interval of time between two consecutive interest calculations. That is, the compounding period is the period of time between the dates of successive conversions of interest to principal. For example, an interest rate that compounds monthly means that the compounding period is monthly, and so the interest is calculated and added to the principal every month. This is where you enter how much compound interest you expect to receive on an investment or pay on a debt.

Tax and inflation combined make it hard to grow the real value of money. For example, in the United States, the middle class has a marginal tax rate of around 25%, and the average inflation rate is 3%. To maintain the value of the money, a stable interest rate or investment return rate of 4% or above needs to be earned, and this is not easy to achieve.